If 2024 was about anticipation, 2025 was about repricing.

Markets spent the year rotating between themes.

Growth cooled, then re-accelerated.

Safe havens came back into focus.

Volatility stayed elevated across asset classes.

Rather than one clean trend, 2025 delivered clear winners, sharp pullbacks, and fast leadership changes.

Top 3 Winning Stocks of 2025

While market leadership rotated throughout the year, three stocks stood out for their ability to attract sustained interest and outperform broader benchmarks.

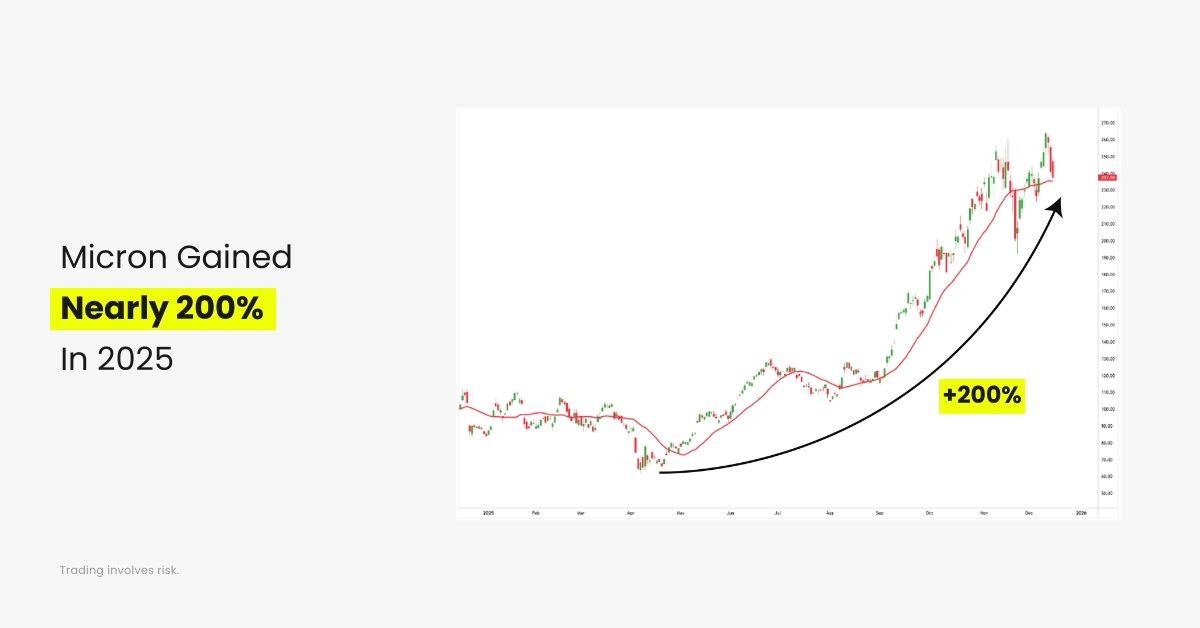

Micron Technology (MU)

Micron (MU) gained around 200% from its 2025 lows, marking one of the stronger stock performances of the year.

The company mainly benefited from renewed optimism around the semiconductor cycle. Memory pricing stabilized, AI-related demand improved visibility, and expectations around the next capex cycle helped shift sentiment. MU’s performance reflected a broader theme in 2025: selective strength within semiconductors rather than blanket buying.

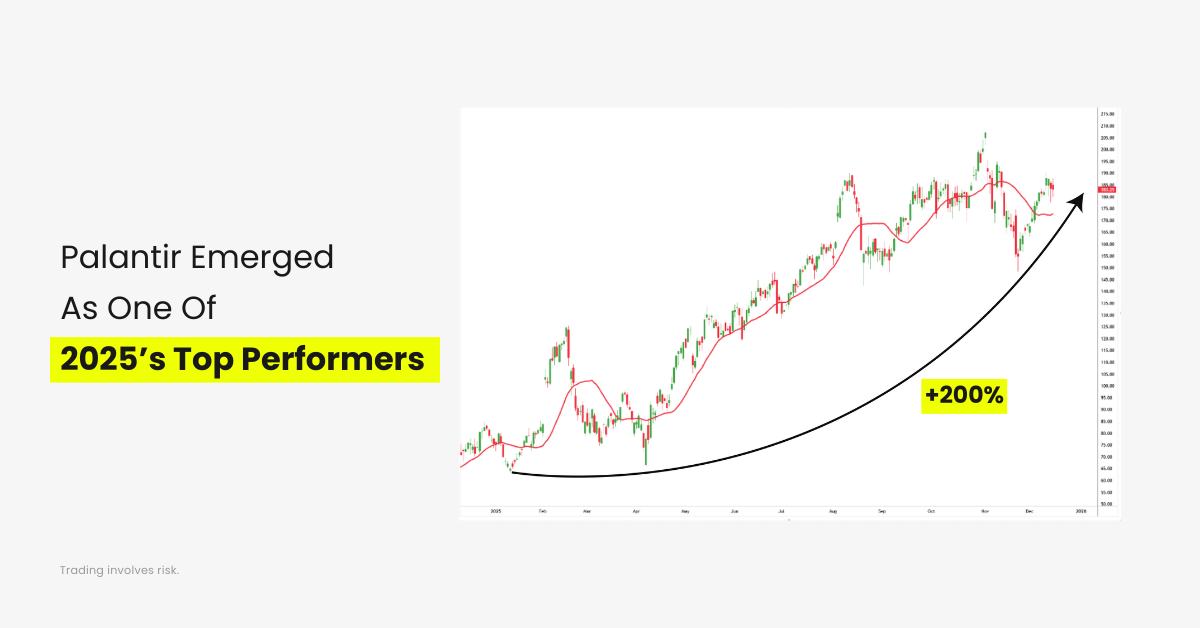

Palantir Technologies (PLTR)

Palantir Technologies (PLTR) surged more than 200% from its 2025 lows, very similar to MU.

The security company remained one of the most talked-about stocks of the year. Its focus on government contracts, enterprise software, and AI-driven analytics kept it in focus even during periods of broader tech consolidation. PLTR’s strength highlighted how recurring revenue models and clear use cases were rewarded as markets became more selective.

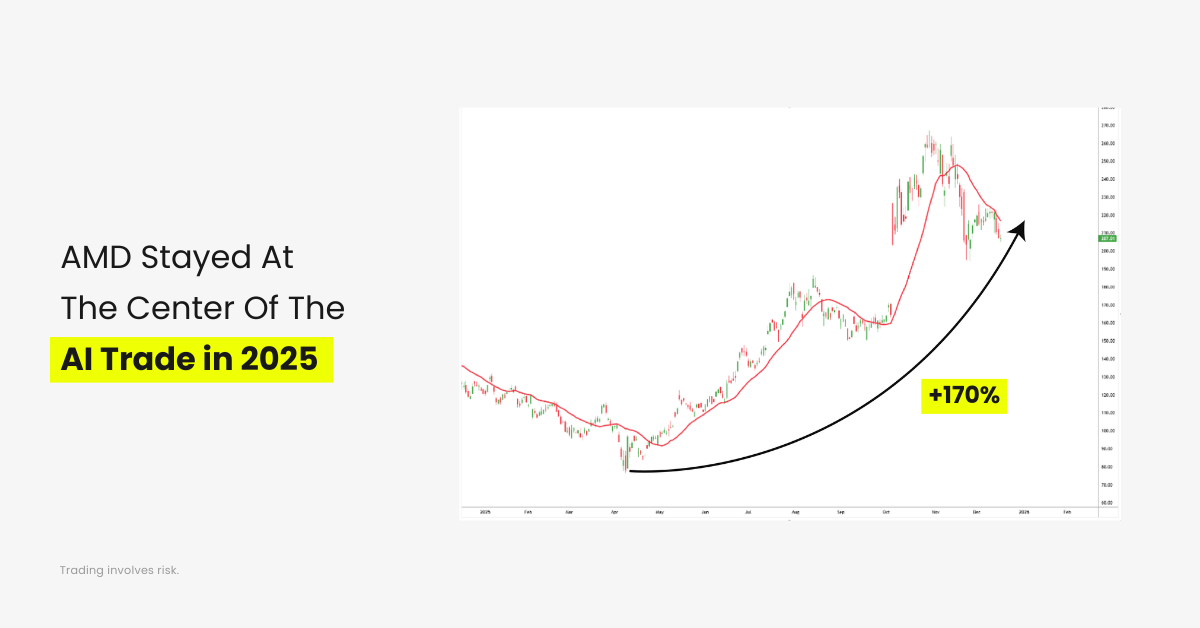

Advanced Micro Devices (AMD)

AMD benefited from its positioning across data centers, AI acceleration, and high-performance computing. While competition in the chip space remained intense, AMD managed to stay relevant within the AI narrative and avoided the sharp sentiment swings seen in more speculative names.

Top 3 Losing Stocks of 2025

Not every high-profile name navigated 2025 smoothly. Several stocks struggled as growth expectations reset and competition intensified.

Lululemon Athletica (LULU)

Lululemon faced pressure from slowing consumer demand and rising competition within the premium apparel space. Margins came under scrutiny as discretionary spending softened, leading to underperformance relative to broader consumer benchmarks.

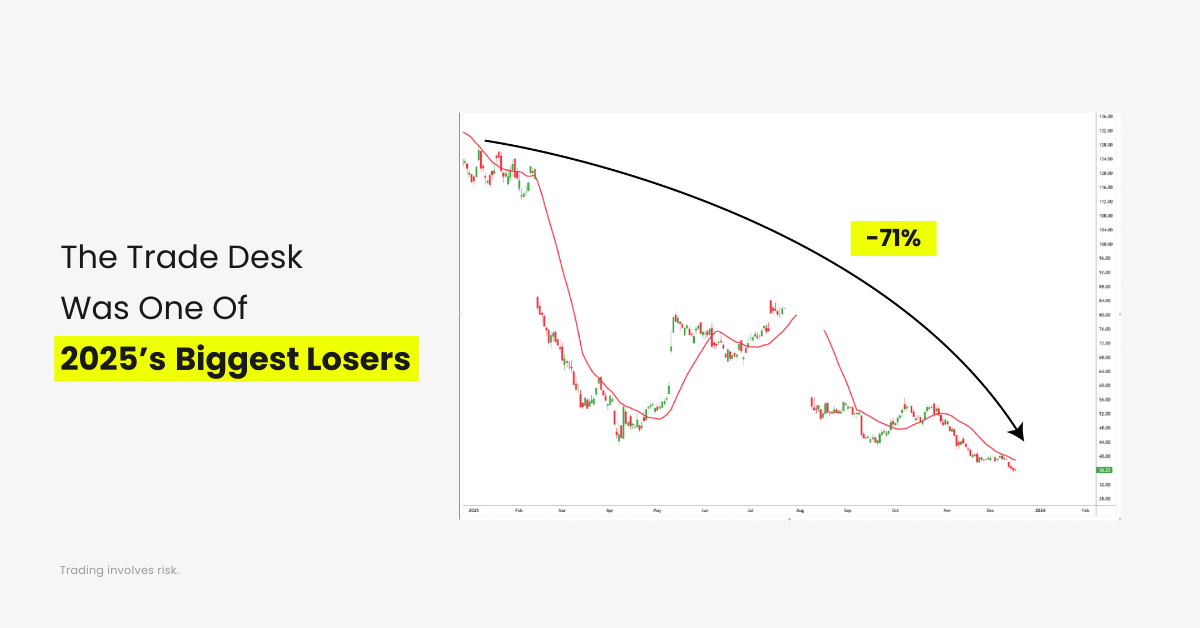

The Trade Desk (TTD)

The Trade Desk was one of the more notable decliners among large-cap tech stocks. Concerns around advertising demand, increased competition, and slower growth momentum weighed on sentiment. The stock’s performance reflected how unforgiving markets were toward any sign of deceleration in high-multiple names.

FactSet Research Systems (FDS)

FactSet struggled as investors reassessed the long-term outlook for traditional financial data and analytics providers. The rise of AI-driven tools and changing client demand raised questions about growth sustainability, pushing the stock lower over the course of the year.

Gold and Silver: A Historic Year for Precious Metals

Precious metals were among the clear winners of 2025.

Both gold and silver traded at new all-time highs, supported by a powerful mix of technical and macro forces.

On the charts, gold and silver both completed long-term cup-and-handle formations, patterns that took decades to develop. These breakouts drew attention from traders focused on long-term structure rather than short-term momentum.

Beyond the charts, macro conditions played a key role:

- Expectations for interest rate cuts reduced the opportunity cost of holding precious metals

- Geopolitical risks remained elevated across multiple regions

- De-dollarization concerns continued to drive demand for assets outside the traditional financial system

- Investors sought protection against long-term currency debasement and purchasing power erosion

Silver’s dual role as both an industrial and monetary metal added to its volatility, while gold continued to act as the primary safe-haven anchor.

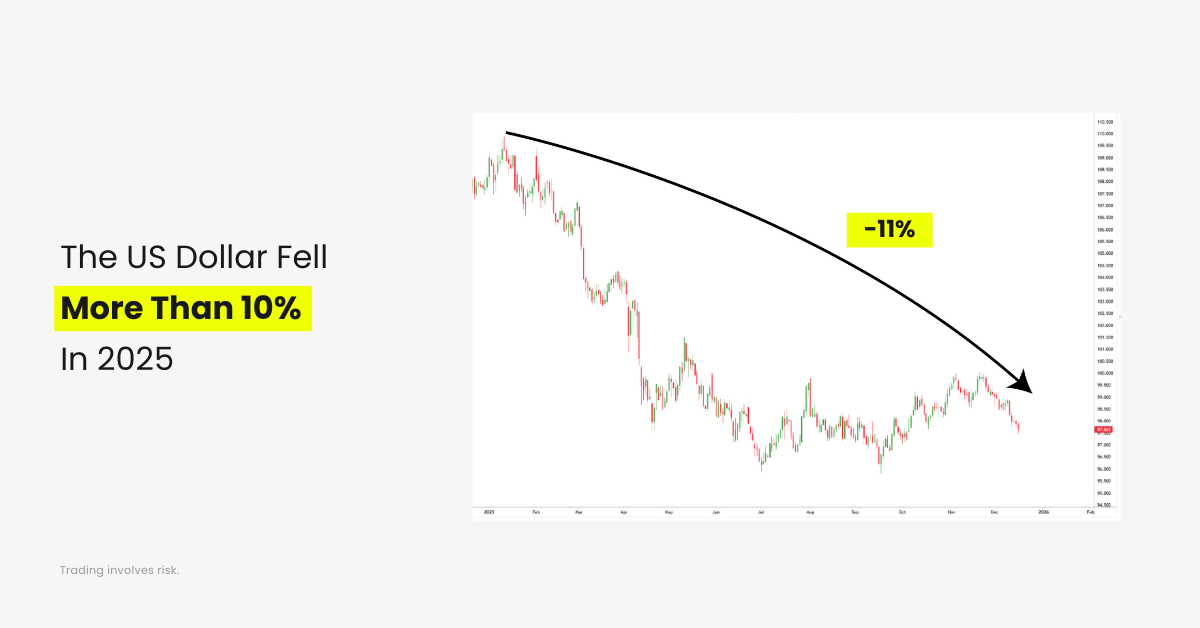

The US Dollar (DXY): A Weak Year for the World’s Reserve Currency

The US dollar was one of the notable laggards of 2025.

DXY declined by more than 10% from the start of the year, reflecting a shift in global capital flows and changing expectations around US monetary policy.

The move was not driven by a single event. It was the result of several overlapping fundamental pressures.

Falling Rate Expectations Weighed on the Dollar

As markets moved deeper into the later stage of the interest-rate cycle, expectations for future rate cuts increased. Lower expected yields tend to reduce the appeal of holding dollars, especially when other regions begin to stabilize or offer competitive returns.

Even before cuts materialize, the direction of policy often matters more than the timing. In 2025, that directional shift worked against the dollar.

Foreign Treasury Selling Added Pressure

Another factor was ongoing foreign selling of US Treasuries, particularly by China. While this process has unfolded gradually over several years, it remained a background pressure on the dollar throughout 2025.

Reduced reliance on US debt holdings signals a broader effort by some countries to diversify reserves, which can influence long-term demand for dollars.

Gold Accumulation and De-Dollarization Concerns

At the same time, central banks continued to increase gold purchases, reinforcing a trend away from exclusive reliance on fiat reserves. This coincided with rising discussion around de-dollarization, especially among emerging markets seeking alternatives to the US-centric financial system.

Gold’s strength and the dollar’s weakness reflected two sides of the same shift: a reassessment of where long-term value and stability reside.

What It Means Going Forward

If rate cuts continue into 2026, the dollar may remain sensitive to further downside pressure. That said, the USD still benefits from deep liquidity, global trade usage, and its reserve status.

Rather than a collapse narrative, 2025 highlighted a rebalancing phase, where the dollar faced stronger competition from hard assets and alternative reserve strategies.

The Macro Outlook for 2026: What Comes Next

Markets moved away from peak tightening and toward the later stages of the interest-rate cycle. While rate cuts were not always immediate, expectations around future easing shaped asset prices throughout the year.

By year-end, investors were focused less on whether cuts would happen and more on:

- Timing

- Pace

- Economic resilience once policy begins to ease

Looking ahead to 2026, attention is likely to remain on:

- Central bank communication

- Inflation trends

- Growth durability

- Liquidity conditions

Rather than aggressive optimism or outright fear, markets appear to be entering a phase of measured recalibration, where data and policy guidance matter more than narratives.

For a deeper breakdown of these themes and what markets may be watching next, read our upcoming article next week.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.