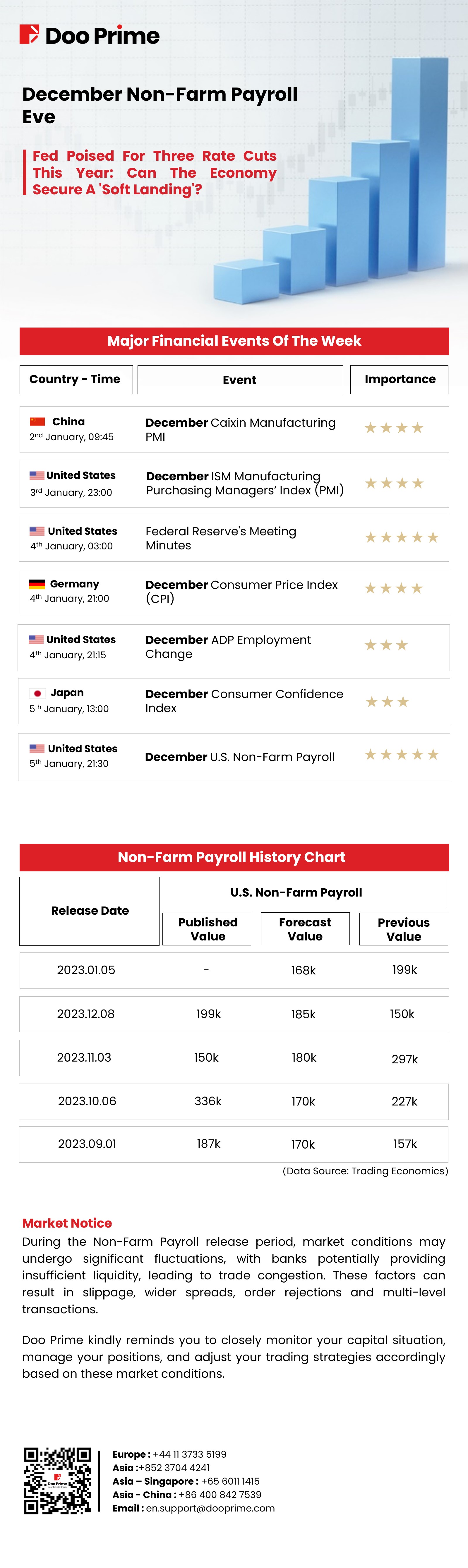

The U.S. non-farm payroll data for December is set to release this Friday, January 5th, 2023.

The Federal Reserve in the U.S. is close to achieving a rare accomplishment by controlling inflation without causing a significant spike in unemployment—a scenario often termed a “soft landing.”

Despite the highest interest rates in over two decades, last year saw inflation slowing down without a corresponding increase in unemployment, while consumer spending remained steady.

This success has not only fueled optimism for a soft landing but has also prompted discussions about the next phase in the Fed’s fight against historic levels of inflation: a potential reduction in interest rates.

In December, officials projected three rate cuts for 2024, but market expectations suggest double that number, potentially starting as early as March.

The direction the economy takes in 2024 will be pivotal for the Federal Reserve, the most influential central bank globally.

In addition, let’s turn our attention to the imminent release of other significant economic datasets.